NerdWallets Best Accounting Software for Amazon FBA Sellers

By: Flaka Ismaili October 28, 2020

Content

Connect your Shopify store to your https://www.bookstime.com/ account for easy management of your ecommerce business finances. Finaloop is different from Quickbooks and Xero in that it includes not only an accounting software but also an accounting service as well as its own in-house app integrations. Taxes are another major area that sellers either forget about or like to hold off as long as possible. Failing to understand the basics of taxes can do some major damage to your business though. Did you borrow money or hired products, equipment, and other business essentials?

What is Amazon bookkeeping?

Simply put, Amazon seller bookkeeping is the recording and storing of a merchant's day-to-day financial transactions. Common financial transactions include sales, purchases, shipping costs, money paid to suppliers, loan payments, and advertising spend.

Unless you have rock-solid processes and procedures in place for your bookkeeping, the chances of mistakes are high. Errors on the books can cost you a lot of time and money to clean up when it comes time to pay your taxes. For one, if you ever decide to apply for a business loan, you’ll need to provide the creditor with various financial information.

Understand net sales revenue.

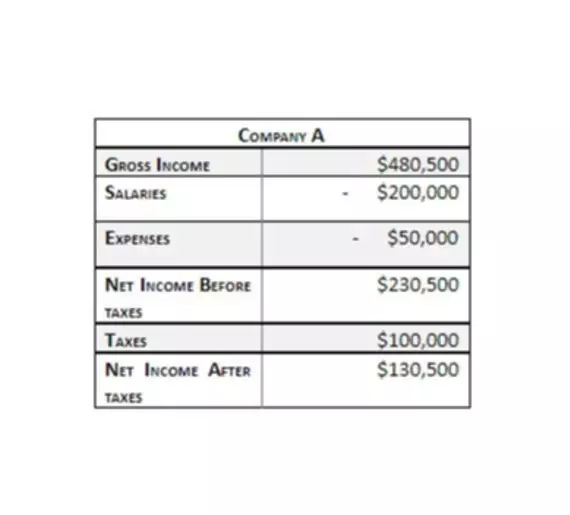

Registering your amazon seller accounting can protect you from certain liabilities if things go wrong, and allows you to separate your business from personal income. As the business owner, you are wholly responsible for your legal and tax obligations. At least once per quarter, it would be best if you created a cash flow forecast. If your business is volatile or is in a global recession and pandemic, you would want to run this report more often. The P&L report will let you efficiently see all revenue and expenses during a given period. One of the most effective business decisions you can make today is to save the time you are spending on FBA accounting and spend it on growing the business.

Quickbooks was also founded with the intention of helping small business. It is available on multiple platforms for you to manage your sales on the go and is also cloud-based. It helps with bank reconciliation, tracking expenses, drafting invoices, and monitoring financial reports among others. Keeping tabs on them all using a spreadsheet shouldn’t be too difficult if you only sell a few different items. You may wish to switch to using inventory management software as you begin to carry more SKUs. This software can assist you with this work and keep you on track. Impressing potential buyers or lenders, you should trust a certified public accountant or an agency with experience in the field.

A2X Accounting

Customized instructions for payment can be included in each invoice. And, sellers can easily set up a workflow to process and send recurring invoices to simplify payment. Denali Business is primarily a Windows-based desktop accounting application, which means that it must be installed on a single desktop or server. After the software is installed, the application can be accessed by users from that location or remotely via the cloud, which is a recent change to Denali Business’s model. Even at its most expensive tier, GoDaddy Online Bookkeeping is clearly meant to be used by small sellers, such as sole proprietors. Therefore, the application doesn’t come with the administrator’s ability to create a host of users and accounts. But, there are also handy mobile apps for both Android and iOS that allow users to enter transactions from anywhere.

- Bookkeeping has been around ever since the double entry accounting system was invented in 1494, but as you can probably imagine, lots of things have changed since then.

- Kashoo breaks the mold of the tiered pricing models of many accounting programs for FBA and FMB online merchants.

- Unless you have rock-solid processes and procedures in place for your bookkeeping, the chances of mistakes are high.

- Besides this, you also need to manage accounts payable, send online invoices, keep records in accordance with FASB, ensure your books are balanced, and do much more.

- With multiple video tutorials and online assistance, anyone can learn how to operate Quickbooks online with ease.

Intuit does provide a number of support features to help users acclimate to QuickBooks Desktop, but it is a comprehensive, full-featured platform that may take some getting used to. We believe everyone should be able to make financial decisions with confidence. Accounting may not be your favorite part of running an ecommerce business, but you don’t have to dread it.